I must admit it actually took me a bit to come up with that title, true as it is. Hey folks, Max here with the weekly update, and as noted above, this week it’s full of dragons. Why? Well, because I’ll be talking about two dragon books today.

Furthermore, the first one I’m going to talk about is not my own.

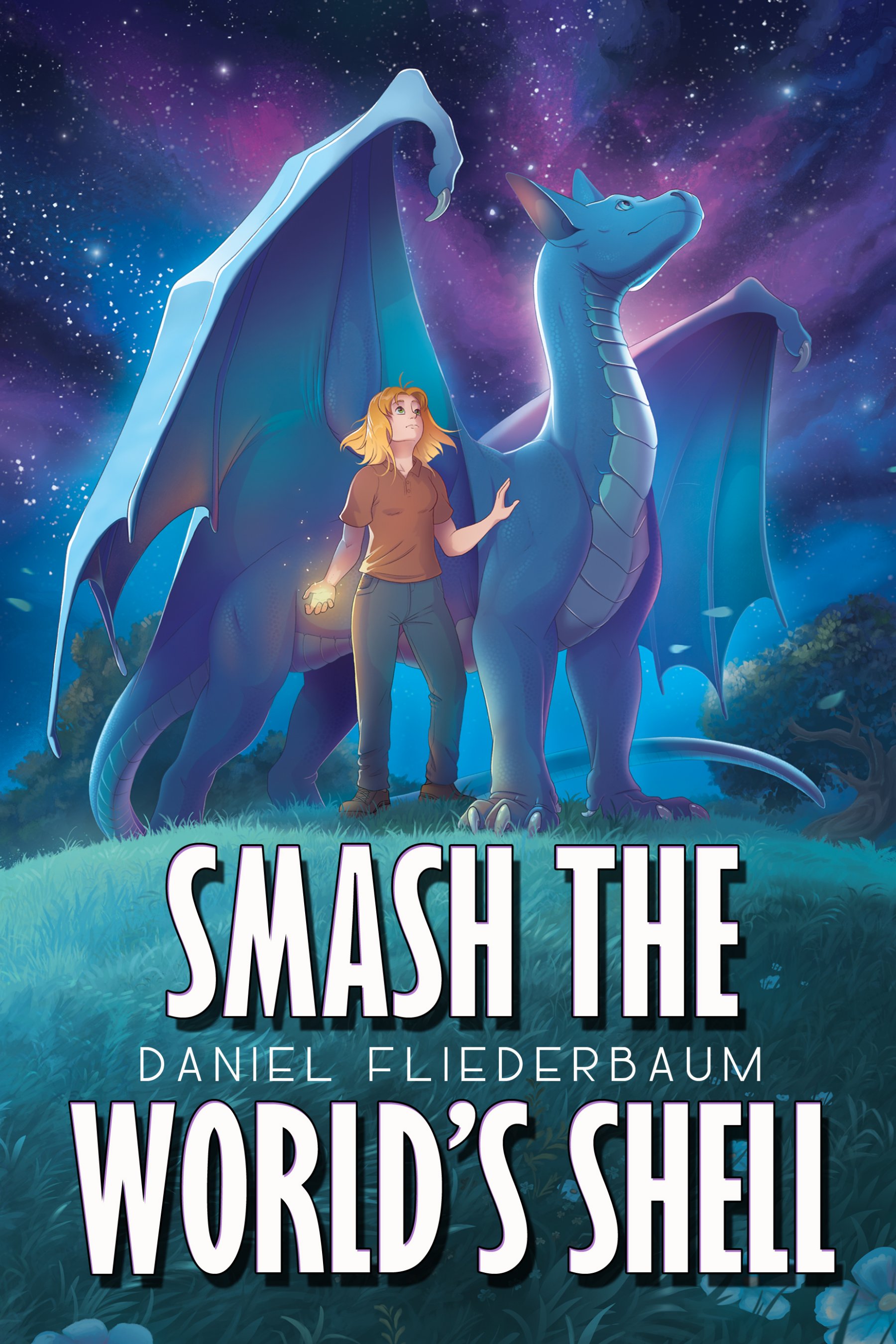

This is Smash the World’s Shell, by Daniel Fliederbaum, who perhaps holds a unique place on this earth for having one of the rare names that starts with an “Fl” but can make one wonder on pronunciation as much as mine.

Smash is Fliederbaum’s debut novel, a YA Semi-Slice-of-Life Fantasy following two young characters whose lives are on a collision course. And one of them is a dragon.

This does not end in dragon riding. Yes, you read that correctly, and it’s rare enough among fiction of this type that I’ll state it again: It does not end in dragon riding. In fact, it does something very novel instead.

Of course, I’m not going to spoil what that is. If you’re curious, and the synopsis—which you can read by clicking the cover above—sounds like something you’d like to read, you’ll have to try it for yourself. As to why I’m mentioning it, it’s not just because Fliederbaum sent me an early copy and asked me to read it—though he did, just to be clear; and I did read it and enjoy it, though I will note it was pre-release—but because it did something novel. Again, not spoiling it, but I like novel things.

You can check it out further by clicking that cover above, which will take you directly to the publisher page where you can check it out. Which does include samples to check out.

You’ve got the link, the choice is yours. Onward to Axtara news!

So, what’s the status of Magic and Mayhem so far? Well, the draft is currently sitting at 122,000 words. Which is about the length of the prior Axtara title but … this one’s not done yet. Granted, it’s still in writing, and may get some chapters truncated in editing, but for now, it’s 122,000 words of Axtara, and that number is continuing to grow.

There have been some great moments between Axtara and Mia with this draft too, though I won’t share them because they also happen to include some major plot spoilers that I’d rather keep under wraps for a moment longer.

But I think you’d all like a bit more than just a notification that “work is ongoing” so I will drop this little tidbit for you all. Remember Wilfor, the young courier’s apprentice? Well, he’s back and he’s inquisitive. Check it out:

“Are [seafolk] pretty? The stories say they’re really pretty, and it’s how they lure people in to eat them. But you say they don’t eat people, so are they not pretty?”

“That’s a difficult question. I suppose it depends on your definition of beauty.”

“Huh?” Wilfor’s face scrunched up in confusion.

“You’ll understand as you grow older, but not everyone finds the same things attractive, Wilfor.”

“Kind of like how my brother can’t stop staring at—?”

“Similar to that, yes,” she said quickly, cutting off whatever innocent but untoward thing the boy had been about to innocently say. “And I have heard many say that seafolk are quite attractive by human standards.”

Wilfor gave her an odd look, [REDACTED]. “I personally have never found them that attractive,” she covered. “But the ways of the heart are complicated.”

“They must be,” Wilfor said. “My mother and father don’t want anyone around when they want to be lovey.”

Kids, am I right? With that said, I should get back to work. But first, one last bit of news …

Remember about three years ago when it was announced that Viacom was selling off Simon and Schuster, noting that outside of a few outlier years, they’d not made a profit in over thirty years? I spoke a little bit about it then.

Well, as of yesterday, the sale has been finalized. S&S was not acquired by a hopeful Penguin-Random House, as the courts ruled that something like 78% of all US book sales would be a little too much. Instead, S&S was sold whole to KKR, a venture/vulture capital firm private equity fund. Given the firm’s track record of running companies into the ground to extract a bit of profit before selling off all the broken pieces, combined with the detail that S&S is already effectively a sunken ship, means that what began three years ago, when S&S was taken out of the running and the “Big Five” became the “Big Four” has finally reached its conclusion.

It’s going to be interesting to see which of the four is the next the fall, given the number of authors that have stepped away from publishing houses recently.

It’s an interesting time to be an author!

Anyway, I need to get back to work on Axtara. See you all Monday!

Ouch. Vulture capitalists in charge of a publishing company. How could we tell the difference?

LikeLike

I’ve heard of Smash The World’s Shell earlier this week! I am considering buying it, but I’m waiting to see some more early reviews first before I make a final decision.

I am curious about that little snippet into the next Axtara book. Seems like we’re getting some new races introduced into the story!

KKR isn’t a venture capital fund. They are a private equity fund, which is quite different. The former only invests in early stage companies and would not be going after anything that is even remotely established. Private equity is a different story and is the opposite. They typically only invest in established businesses (except in very few specific cases like infrastructure).

I am concerned about the takeover deal more from the debt that will be loaded into S&S. S&S wasn’t struggling, so I’m less worried about mass layoffs and major restructuring exercises for now, but the debt servicing load has been typically what I’ve seen sink private equity investments in the past. Its Loan-To-Value ratio of around 62% isn’t that bad from what I’ve seen, but its still USD 1b which is a huge amount.

The repayment of that loan and the interest costs are going to be a heavy drag on cash flows and resources that could otherwise have been used to invest into other areas, such as enhancing product offerings. This might be the other killer of businesses in the long term, where companies are left less able to compete against their peers for a considerable amount of time.

LikeLiked by 1 person

I amended the post correcting what KKR was. I was misinformed (or misread, also very possible).

I am curious about your statement that S&S wasn’t struggling, however. Viacom’s reason for selling them off was being unable to make a net profit (barring a few exception years) for over three decades, which would seem to indicate that they were only kept afloat by virtue of Viacom shoveling funds at them to make up the difference.

I know that this doesn’t mean portions of S&S weren’t doing all right, but overall if they were operating at a loss, that wouldn’t seem to imply they were functioning well by comparison to, well, anything.

Given that record, my assumption would be that the new owners would clean house and then sell off bits and pieces to make up on their investment, as I didn’t see them deciding to try and salvage the whole publisher as is. Especially when the larger publishers seem to be struggling even if they are solvent.

LikeLike

I think you might’ve misread Paramount’s (previously known as Viacom) recent statement. According to a statement by Jonathan Karp, president and chief executive of S&S:

“S&S has never been more profitable and valuable than it is today and possesses what is currently the bestselling backlist in the publishing industry.”

From: https://www.latimes.com/entertainment-arts/books/story/2022-11-21/simon-schuster-penguin-random-house-sale-withdrawn-paramount

Since this isn’t a turnaround kind of a story, my interpretation is that KKR would likely make some minor cost cuts at most. But what would really drive their returns is (1) aggressively expanding top line revenue, which if they are going for could be a plus if that translates to them being more aggressive in securing new creative works, and/or (2) playing the financial engineering game with debt, which is always a big driver of returns in these kinds of leveraged buy outs.

I would agree though, that if S&S was loss making, then very likely the new owners would carve off non-core areas to make the business profitable (possibly with some savage cost cuts), and I honestly can’t really blame them for such actions in such a scenario. It will be painful of course, but I think on a net basis its better to save what u can rather than have the enterprise bleed out entirely and close down.

LikeLike

I wonder if that’s just marketing niceness, because the original statement when they announced the sale in 2020 (which is linked in the original article, but now behind a paywall) was that S&S hadn’t made money in years and they were tired of chasing a failing venture.

LikeLike